About Us

Thanks for your interest in silver investment... This is a world of uncertainly, sometimes silver investing can be pumped up to be something it's not. This is a brief summary about us at cwcash.com.

Just note that we do not personally sell silver... we have nothing to sell. This is an informational silver investing site based on personal experience as a novice, small scale, retail investor. All investment advice available on www.cwcash.com is for entertainment purposes only. Read and invest at your own risk.

Silver investing is just one road to travel regarding long term investments, particularly retirement cash. Long term investments fall into the category of retirement savings or simply higher return savings for future financial stability. Silver has been pegged by the media as a great choice in precious metals based on its affordability and it overall lag in pricing considering the remainder of the precious metals market.

Silver investing is just one road to travel regarding long term investments, particularly retirement cash. Long term investments fall into the category of retirement savings or simply higher return savings for future financial stability. Silver has been pegged by the media as a great choice in precious metals based on its affordability and it overall lag in pricing considering the remainder of the precious metals market.

The silver price moves about daily with the global markets, pencil-pushing financial gurus will tell you that silver is very volitile. I watch the silver price daily on the NYSE, even though silver is not meant for day-traders. Prices can actually change after hours being that silver is traded globally. Watching silver prices gets addicting after a while but you can't worry about daily changes too much. Silver is best invested long term, and if all goes as well as I think it will, for retirement cash down the road.

This is my attempt to share my knowledge of silver investing based on personal experience as a retail investor. Following media reports and encouragement from financial connoisseurs, I took an interest in silver investing and I will openly share the knowledge I have accumulated over the last few years.

I do not sell silver, I am a buyer, a collector, a saver, an investor. I have made a choice to invest in silver as a precious metal investment with the hopes of cashing in later in life, preferably following retirement. I am considered a retail silver investor meaning I actually walk in to local coin and currency stores, I visit flea markets, I sometimes buy online from US mints or eBay, and I also purchase at estate sales when I can. I am not a day trader, I have chosen silver for a long term investing tool, hopefully helping finance my own retirement at some point in time.

With inflation runny wild and lousy economic news around the world, I found myself looking for another way to safely invest my meager savings in something other than a standard savings account at the local bank. I looked at certificates of deposit, money markets, and eventually started to watch the stock market with thoughts of long term investment in stable companies.

Following the ups and downs of Wall Street, it didn't take long for me to realize that those who get ahead play with stock are far and few between or they are some sort of insider. During a conversation with a co-worker about retirement twenty years out, I instantly became fascinated with silver. It started with the words: "You can't print more silver..." One very important aspect to any investor is diversity, no matter how good any investment vehicle appears, it is always smart to diversify. As much as I like silver coins and bullion, I still diversify, basically restraining from putting all eggs in one retirement basket.

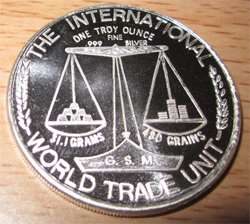

I visited a local coin shop (or LCS) located near my home and after a detailed sales pitch by the store's employee on duty, I purchased my first Troy ounce of silver bullion. I have slowly but surely purchased small quantities of one or two ounces at a time whenever I can. I am not capable of any large scale purchases, but as I look at the silver spot price charts of ten years ago, I can only wish I began my quest to stockpile silver bullion back then.

Hindsight is 20/20, of course. I read silver forums where the members talk of 100 Troy oz purchases and larger. I have not taken my investing to that level and I don't think I will any time soon. I began looking at websites like BGAS and JM Bullion and quickly realized that silver bullion does not come cheap, but in small quantites feels like a worthwhile investment.

In a nutshell, I have learned that silver investing is not a get rich quick scheme. It is a good, sound investment for those who wish to vary their savings portfolio. Returns for me have been good to this point, but not great. I feel comfortable in my choice and will continue to collect silver as I intend to hold silver for a long period of time.

Please read on and maybe you can use my personal wealth of knowledge as a guide to determine if silver investing is right for you. The information and advice is free to anyone who has taken even the slightest interest in acquiring physical silver for financial use in your retirement or somewhere in the future yet to be determined.

Generally speaking, this website is set up so you can read through the pages in order, just look for the navigation at the bottom of the page to move forward (just look for: Read more... Next Page).

Enjoy...

See Also: About Silver Cash | Buy Silver Online | Privacy Policy | Terms of Use